How to Simplify Credit Application Process with Free Checklist Spreadsheet Template

In the B2B world, most companies rely a lot on credit deals. This makes a smooth credit application process very important. It’s key to follow data protection rules and keep data safe to build trust.

Manual credit application steps can take a lot of time, especially with many applications. This can cause delays in making credit decisions. It can also lead to unfair or wrong decisions because of inconsistent checks.

Errors in data entry are a big problem in manual steps. These mistakes can affect credit decisions and need extra time to fix. Using automation can solve these issues, making the process more efficient.

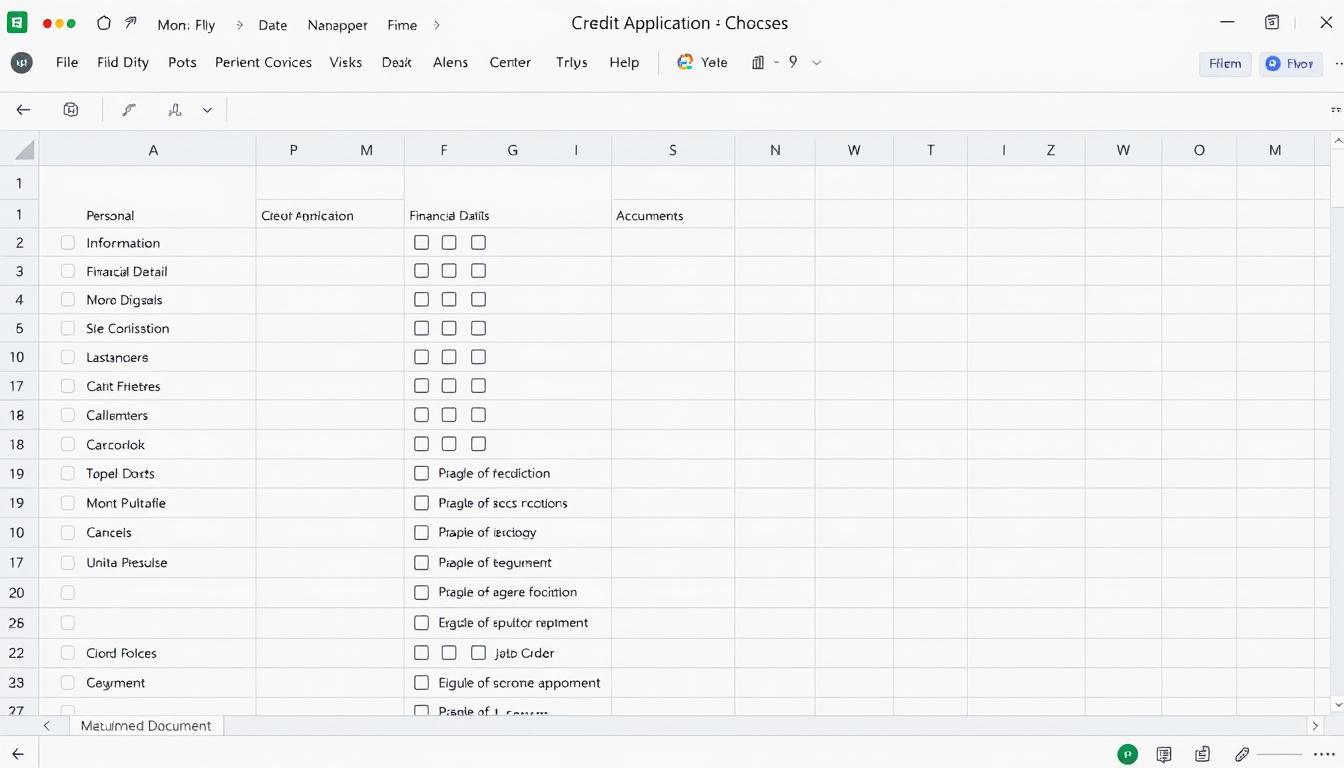

Using credit application process checklist spreadsheet template in managing credit risks can reduce risks and make things simpler. A free checklist spreadsheet template can help you organize your credit application steps. It ensures you don’t miss anything and makes tracking and managing easier.

What Is a Business Credit Application?

A business credit application gives important details about the business and its finances. This helps the creditor decide if the company can pay back the debt. These applications are key in the credit assessment process. They give the creditor the info needed to make a smart choice.

The information in a business credit application usually includes:

- Company details (name, type, address, etc.)

- Ownership and management information

- Financial data (revenue, assets, liabilities, etc.)

- Trade references and credit history

- Requested credit amount and terms

- Legal authorization and supporting documents

By giving this detailed information, the credit application helps the creditor fully check the applicant’s creditworthiness. This way, they can decide if to give a line of credit to the business. Effie’s built-in mind mapping and outlining tools can further enhance this process, helping organize key details logically and efficiently.

See how Effie transforms your note-taking experience. Try Effie for free today.

Key Elements of a Successful B2B Credit Application

A good credit application should have these main parts:

- Financial Data: Ask for financial statements like balance sheets and income statements. Also, get credit references, bank info, and tax returns.

- Trade References: Ask for a list of suppliers or vendors the company has worked with before. Include their contact info and payment history.

- Credit Request: Have a section for the company to say how much credit they want, their payment terms, and any other important details.

- Legal Authorization: Add a part where the company can sign off on credit checks and confirm the info they gave is correct.

- Supporting Documentation: Tell the company what extra documents or info they need to send, like licenses or certificates.

By adding these important parts, you can make a successful credit application. It will get the info needed to check if the company is creditworthy. And it will still be easy and quick for the company to use. Effie’s text-expanding capabilities can help here, allowing users to elaborate on essential points without overloading the application.

Expert Tips for Creating a Credit Application

Making a good business credit application is key. It shows how trustworthy a company is and makes lending easier. Experts say there are important steps to follow. These steps help make the application work well and lower risks.

Ensure Privacy and Data Security Compliance

Keeping the applicant’s personal info safe is very important. Use strong security to protect their data. This shows you care about their privacy and helps build trust.

Ensure Scalability and Flexibility

Make the credit application grow with the business. Add features that let you update it easily. This keeps the application useful as the company changes.

Follow these expert tips to make your credit application better. This will make the process faster, safer, and more successful for your business and customers. Using Effie’s intuitive and clean interface can make filling out and reviewing the credit application an effortless task.

Challenges of Manual Credit Application Processes

The manual credit application process faces many challenges. These include inefficiency, inconsistency, and inaccuracy. These issues often arise from traditional methods like paper or credit spreadsheet.

Time-Consuming Processes

Manual credit applications take a lot of time, especially with many applications. This causes delays in making credit decisions. It frustrates both the applicant and the credit provider.

Inconsistent Credit Risk Evaluation

Manual processes lead to inconsistent credit assessments. Different analysts may use different criteria. This can cause inaccurate decisions due to a lack of standardization.

Data Entry Errors

Manual data entry is prone to errors like typos or wrong numbers. These mistakes can greatly affect credit decisions and data accuracy.

These challenges show the need for a more efficient, automated solution. Such a system would streamline the process, ensure consistency, and improve data-driven decision-making. Effie’s AI-generated summaries and grammar checks provide clean and reliable reports, supporting error-free credit applications.

Benefits of Automating Credit Application Processing

These are key to a smoother and more efficient credit application experience.

- Improved Consistency: Automated systems use the same rules for all credit applications. This makes the evaluation fair and unbiased.

- Reduced Errors: Automated systems check data accurately. This cuts down on mistakes and makes credit decisions more reliable.

- Enhanced Data Analysis: Automated systems offer deep data analysis. This helps businesses make better, informed credit decisions.

By using automated credit application processing, businesses can make their operations smoother. They can also make better decisions and give customers a better experience. All this improves the efficiency and effectiveness of their credit application processes.

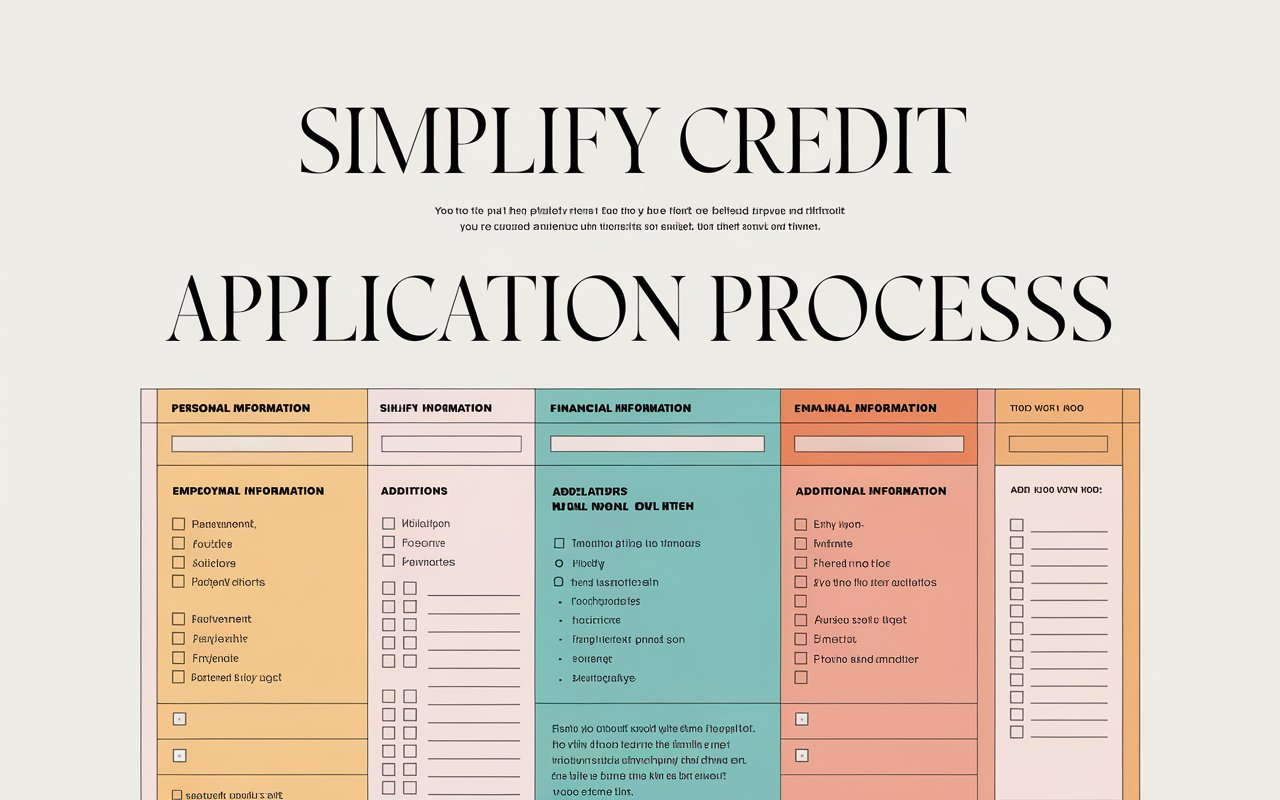

Simplify Credit Application Process with Free Checklist Spreadsheet Template

Streamlining the credit application process can change the game for businesses. A free checklist spreadsheet template is a great tool for this. It helps you organize and manage the credit application workflow, ensuring no steps are missed.

The template offers a structured way to track progress and assign tasks. It keeps an eye on the credit application process. This makes businesses more efficient, consistent, and better at managing their credit applications.

Key Benefits of the Credit Application Process Checklist Spreadsheet Template

- Comprehensive Checklist: The credit application checklist spreadsheet template has a detailed checklist of all key elements for a successful credit application. This includes business information, financial data, trade references, and legal authorization.

- Efficient Tracking: The spreadsheet format makes it easy to monitor each step in the credit application process. This ensures nothing is overlooked.

- Customizable for Your Needs: You can easily customize the credit application process progress tracking template to fit your business’s specific needs. It’s a versatile tool for streamlining your credit application process.

Getting a free credit application process checklist spreadsheet template can be a game-changer for your business. It simplifies and organizes this critical task. This improves efficiency, reduces errors, and enhances your credit management practices.

By using a free credit application process checklist spreadsheet template, you can make the credit application process smoother. This improves efficiency and enhances your credit management practices.

Implementing an Automated Credit Application Solution

Streamlining the credit application process is key for businesses. Using a free checklist spreadsheet template can help. But, an automated credit application solution can do even more.

- Businesses using electronic credit application forms experience a reduction in lost forms, ensuring data security and integrity.

- Electronic credit application forms typically result in quicker processing times compared to traditional paper-based methods.

- A simplified credit application process tends to attract a higher volume of applicants compared to cumbersome processes.

ProcessMaker is an example of an automated solution. It offers tools and credit application process step by step checkoff list spreadsheet template for efficient credit application workflows. By adding an automated credit application solution to existing systems, businesses can improve their credit application process. This reduces manual work and leads to better, more consistent credit decisions. It’s a step towards better credit application process automation.

Features of an Effective Credit Application Automation Tool

When choosing a credit application automation tool, look for key features. These include customizable forms, automated data checks, and credit scoring models. Also, look for workflow automation and real-time reporting.

Customizable Application Forms

The top credit application tools let you create and change forms as needed. This makes sure you get all the info you need. It also makes the application process easy for applicants.

Automated Data Verification

Automated data checks are vital for any credit application automation tool. These tools should verify data automatically. This helps avoid errors and makes sure the info is correct.

Integrated Credit Scoring Models

Using your credit application software with strong credit scoring models helps a lot. It lets you quickly check an applicant’s creditworthiness. This helps you make better decisions and lowers the risk of default.

Workflow Automation

Good workflow management is key for an effective credit application process automation tool. Look for features like task assignment and approval tracking. These help make the review process smooth and efficient.

By focusing on these features, you can use a strong credit application automation tool. It will help streamline your process, improve decision-making, and boost efficiency.

Integration with Existing Systems

When you add an automated credit application process integration, it’s key to make sure it works well with your current systems. This includes your ERP, CRM, or accounting software. This credit application software integration helps move data smoothly, makes workflows better, and keeps all customer info in one place. By linking the credit app solution with your systems, you get a more unified and efficient credit application system integration. This cuts down on manual work and boosts your overall work flow.

Here are some main perks of linking your credit app automation with your systems:

- Streamlined data flow: No need for manual data entry as it syncs automatically between your credit app and other business software.

- Centralized customer view: Get a full picture of your customers by combining their data from different systems in one spot.

- Improved workflow efficiency: Make the credit app process part of your usual business steps, saving time and effort.

By choosing a credit app solution that fits well with your systems, you can make your credit application process integration better. This leads to better operations, growth, and profits for your business.

Conclusion

Streamlining the credit application process is key for businesses. It helps reduce risk, improve cash flow, and strengthen customer ties. Using a free checklist spreadsheet template and an automated credit application process improvement solution can help. This makes the process simpler, more efficient, and helps make better credit decisions.

Choosing the right credit application process improvement solution is crucial. It not only makes the application process smoother but also boosts customer relationships and cash flow. This positions businesses for long-term success in the competitive B2B credit market.

FAQ

What are the key elements of a successful B2B credit application?

A good credit application includes key details. It should be easy to use and gather all the needed info. This includes business info, who owns it, financial data, references, and legal documents.

What are the challenges of manual credit application processes?

Manual processes take a lot of time. They can lead to mistakes and uneven risk checks. They also limit data analysis and monitoring.

How can a free checklist spreadsheet template simplify the credit application process?

Using a free checklist template can make the process smoother. It keeps everything organized and ensures nothing is forgotten. It makes tracking and managing easier.

What features should an effective credit application automation tool have?

Look for tools with customizable forms and data checks. They should also have credit scoring, workflow automation, and real-time reports. These features help improve your application process.

Why is it important to integrate the credit application solution with existing systems?

Integrating with your current systems is key. It makes data transfer smooth and workflows efficient. It also gives you a clear view of customer info, enhancing the application process.

Source Links

- Five Key Steps to Designing a Bulletproof B2B Credit Application – Credit Workbench – https://www.creditworkbench.com/six-key-steps-to-designing-a-bulletproof-b2b-credit-application/

- KYC Form Templates to Use with B2B Clients – Blog | Clustdoc – https://clustdoc.com/blog/kyc-form-templates-and-onboarding-checklists/

- 6 Key Credit Risk Mitigation Strategies – https://www.highradius.com/resources/Blog/strategies-involved-in-credit-risk-management/

- Credit Application Form: The Complete Guide – https://leadgenapp.io/credit-application-form/

- Creating application forms: templates & tips | SurveyMonkey – https://uk.surveymonkey.com/mp/application-forms/?ut_source=content_center&ut_source2=form-vs-survey&ut_source3=inline

- A Free Accounts Receivable Template (Excel & Google Sheets) – https://jetpackworkflow.com/blog/accounts-receivable-template/